Irs Child Tax Credit Tool / Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

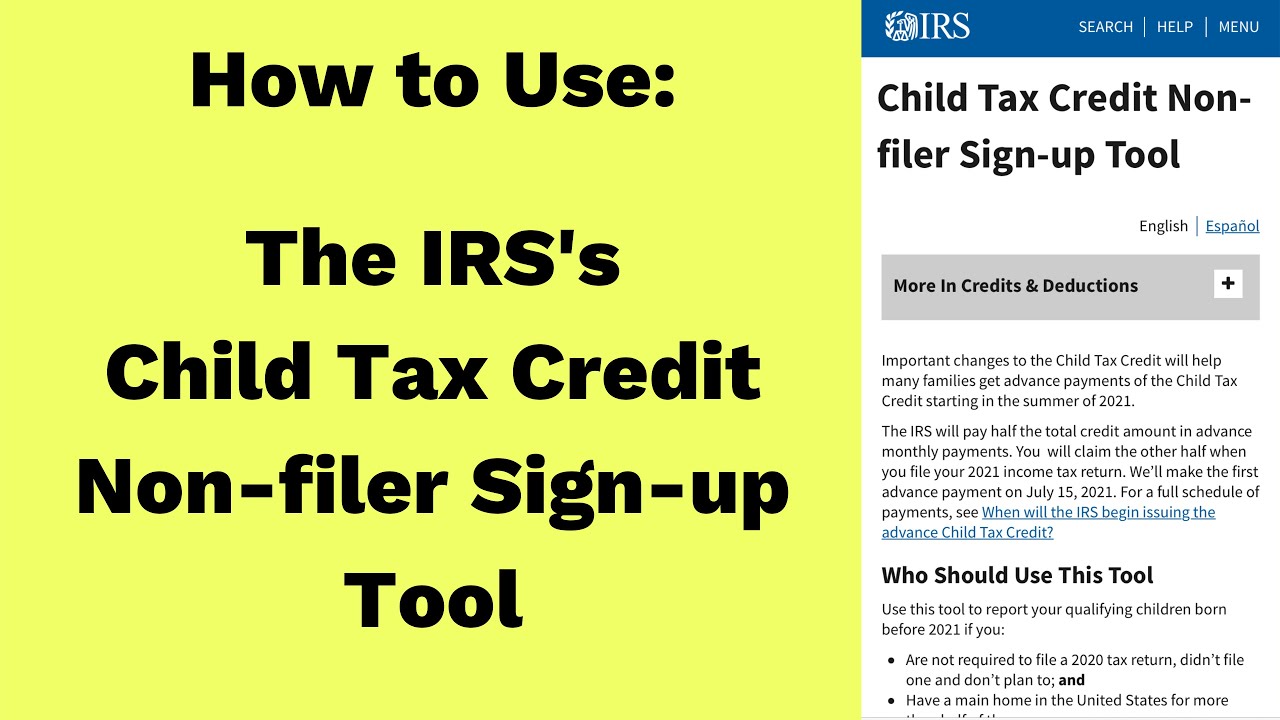

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Optional Tool Available to Track Your Advance Child Tax Credit Payments The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July.

Children Born In 2021 Are Eligible For The Child Tax Credit Verifythis Com

You will claim the other half when you file your 2021 income tax return.

Irs child tax credit tool. Earlier this week Treasury and IRS launched another useful tool the Child Tax Credit Update Portal. The IRS will pay half the total credit amount in advance monthly payments. Businesses and Self Employed.

The interactive tool is now available in Spanish and other languages. Nevertheless it can still help an eligible family determine whether they should take the next step and either file an income tax return or register using the Non-filer Sign-up Tool. Child tax credits latest IRS launches new tool for families receiving paper checks to update their mailing address.

You will claim the other half when you file your 2021 income tax return. Initially this tool only enables anyone who has been determined to be eligible for advance payments to see that they are eligible and unenroll from opt out of the advance payment program. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

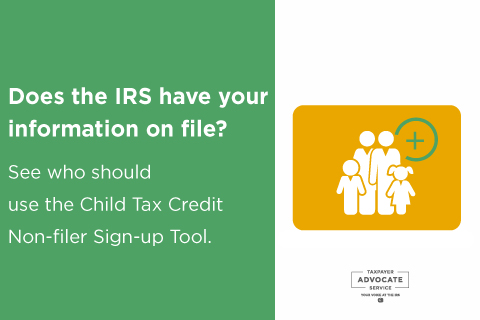

TAS Tax Tip. This tool can be used by low-income families who earn too little to have filed a 2020 tax return but who need to notify the IRS of qualifying children born before 2021. Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax Credit.

This toolkit has everything you need to help you with claims for the earned income tax credit child tax creditadditional child tax creditcredit for other dependents and American opportunity tax credit. Well make the first advance payment on July 15 2021. Parents of dependents ages 18-24 will have to wait until tax time to get the total amount.

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Developed in partnership with Intuit and delivered through the Free File Alliance this tool provides a free and easy way for eligible people who dont make enough income to have an income tax return-filing obligation to provide the IRS the basic information neededname address and Social Security numbersto figure and issue their Advance Child Tax Credit payments. The Child Tax Credit Eligibility Assistant can help you determine whether you qualify for the advance child tax credit payments.

The IRS will pay half the total credit amount in advance monthly payments. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. The IRS emphasized that because the Child Tax Credit Eligibility Assistant requests no personalized information it is not a registration tool but merely an eligibility tool.

ELIGIBLE families receiving child tax credit payments can now easily update their mailing address through a new IRS tool. The Child Tax Credit Eligibility Assistant can help you determine whether you qualify for the advance child tax credit payments. To file a tax return and become eligible see Non-filer Sign-up tool.

Children ages 6 to 17 may yield up to 250 per month and up to 3000 total. Child Tax Credit Update Portal. Businesses and Self Employed.

You will claim the other half when you file your 2021 income tax return. The IRS has established a special section focused on steps to help taxpayers businesses and other affected by the coronavirus on IRSgov. An online tool for taxpayers who dont normally file tax returns has been updated to provide the IRS with information to claim the 2021 Child Tax Credit.

This feature particularly important to households that receive paper checks can use the existing Child Tax. IR-2021-150 July 12 2021 The IRS has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility Assistant designed to help families determine whether they qualify for the Child Tax Credit and the special monthly advance payments of. The interactive tool is now available in Spanish and other languages.

You must have claimed the Child Tax Credit on your most recent tax return or gave us information about your qualifying children in the Non-Filers. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The IRS has launched an online tool to help low-income families register for monthly child tax credit payments.

Similar to certain other credits with an advance payment option taxpayers who receive these advance payments will have to reconcile the total amount received on their 2021 individual income tax return. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Well issue the first advance payment on July 15 2021.

The child tax credit Non-Filer Sign-Up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/AM6GJSKKKJDODBWOIZJY3VOOIA.jpg)

Irs Will Start Sending Child Tax Credit Payments July 15

Child Tax Credit Irs Adds Tools To Help Parents Claim Payments Cnnpolitics

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Update Portal This Irs Tool Lets You Opt Out Manage Payments And More The Paradise

Irs Launches New Tool To Get Child Tax Credit Payments To Non Filers

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit 2021 Will You Have To Repay Use This Irs Tool To Check The Paradise Nigeria

Child Tax Credit Non Filer Sign Up Tool Now Available From Irs For Low Income American Families Abc7 Chicago

Irs Child Tax Credit Tool Monthly Child Benefits Register Online

Child Tax Credit Irs Creates Nonfiler Sign Up Tool

Tas Tax Tips Does The Irs Have Your Information On File If Not See If You Should Use The Child Tax Credit Non Filer Sign Up Tool Taxpayer Advocate Service

How You Can Claim Your Child Tax Credit Money Using Irs New Tracking Tool

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Child Tax Credit Sign Up Tool For Non Filers Verifythis Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Irs Child Tax Credit Tool Monthly Child Benefits Register Online

Child Tax Credits Irs Unveils Online Tool As It Prepares To Send Out July 15 Payments